Medical Benefits

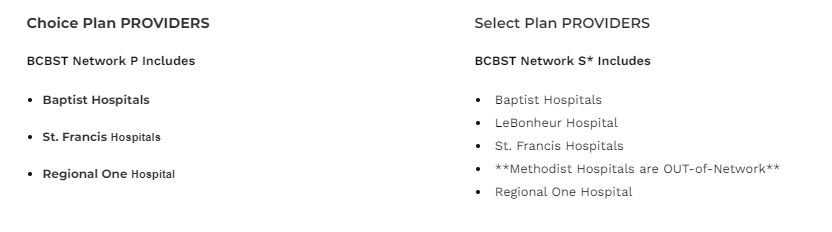

The City of Memphis offers two different medical options for you and your family through BlueCross BlueShield of Tennessee (Choice and Select). You must meet an annual deductible before the plan pays a percentage of expenses. You will pay a copay for certain services. After your (or your family’s) out-of-pocket maximum has been met, the plan will pay 100% of each eligible family member’s covered expenses.

Have questions about your health plan?

Meet with a BlueCross BlueShield of Tennessee expert right here in Memphis to answer your questions about claims, billing, benefits, or anything else about your health plan.

You can save on health care costs by staying in network. By going to in-network doctors and hospitals, you pay lower copays and avoid other out-of-network costs. Use the Find a Doctor tool at www.BCBST.com or the myBlue TN mobile app to see if your doctor or hospital is in your network. You may also call BCBST at 1-888-796-0609.