Your Insurance

The City of Memphis offers two different medical options for you and your eligible dependents through BlueCross BlueShield of Tennessee. You must meet an annual deductible before the plan pays a percentage of expenses. However, if you are enrolled in the Select Plan, you may use funds from your HRA to help you meet the deductible. You will pay copay for certain services. After you/ your family’s out-of-pocket maximum has been met; the plan will pay 100% of each eligible family member’s covered expenses.

Summary of Benefits

Evidence of Coverage

Please read the below evidence of coverage carefully and keep it in a safe place for future reference. It explains your benefits as administered by Blue Cross Blue Shield of Tennessee, Inc.

Medicare

Websites

THE INFORMATION CONTAINED IN THESE VIDEOS ARE THAT OF THE CENTERS OF MEDICARE SERVICES AND NOT OF THE CITY OF MEMPHIS

Help with your Medicare choices https://www.medicare.gov/medicarecoverageoptions/

- There are 2 main ways to get your Medicare coverage – Original Medicare (Part A and Part B) or a Medicare Advantage Plan (Part C) opens a new tab.

- Original Medicare doesn’t cover everything, so many people buy additional coverage, like a Medicare Prescription Drug Plan (Part D) opens a new tab or a supplemental Medigap Policy opens a new tab.

- Health and drug costs not covered by Medicare have a big impact on how much you spend each year. We’ll show you how the coverage choices you make affect your costs.

Find a plan that works for you https://www.medicare.gov/find-a-plan/questions/home.aspx

- Start here to view Medicare Advantage plans (like an HMO or PPO), or Medicare Prescription Drug Plans (Part D).

Your new Medicare Card https://www.medicare.gov/newcard

Videos

Look out for Enrollment Fraud: Below video explains some common Medicare enrollment fraud schemes and how to protect yourself, especially during the Open Enrollment Period (October 15 – December 7).

Health Reimbursement Account

There are two(2) ways to receive a Health Reimbursement Account(HRA) with the City of Memphis.

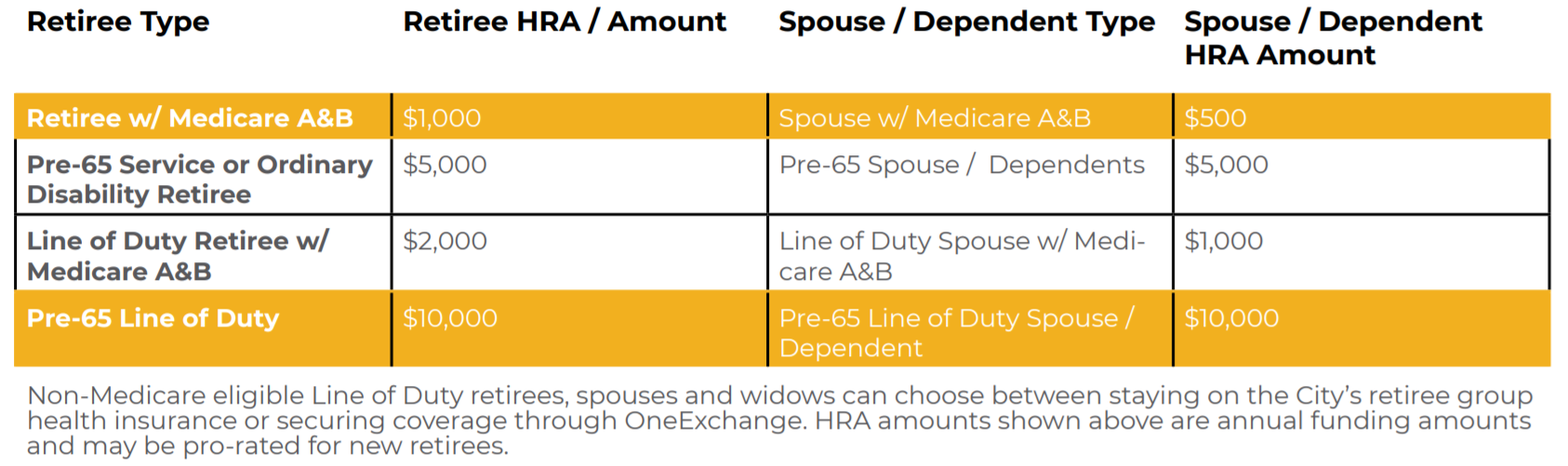

You are eligible for an HRA if you are enrolled in the City of Memphis Select Medical Plan or if you are an employee that has retired from the City of Memphis without any option of staying on the citys’ plan.

You cannot be enrolled both ways.

For Retirees that are enrolled in the City of Memphis Select Plan

| Health Care Options | HRA Amount |

|---|---|

| Retirees Only | $750 |

| Employee + Family | $1,500 |

Your Health Reimbursement Arrangement (HRA) is contributed to you by the City of Memphis each year to pay for health care expenses when enrolled in the Select Plan. If you don’t use it all, the balance will “roll over” to the next year and build up over time.

Rollover Accrual

When selecting a plan, consider whether you have any HRA “rollover” money remaining from previous years. With that extra money, you may benefit financially from choosing a plan with a higher deductible and lower payroll contributions. Keep in mind that your HRA rollover accrual will be capped at the maximum out-of-pocket amount.

HRA Eligible Expenses

- Medical Deductible expenses, Medical Coinsurance and Medical Copay

- Dental expenses

- Vision expenses

- Prescription Deductibles and Prescription Copay

Medicare ViaBenefits

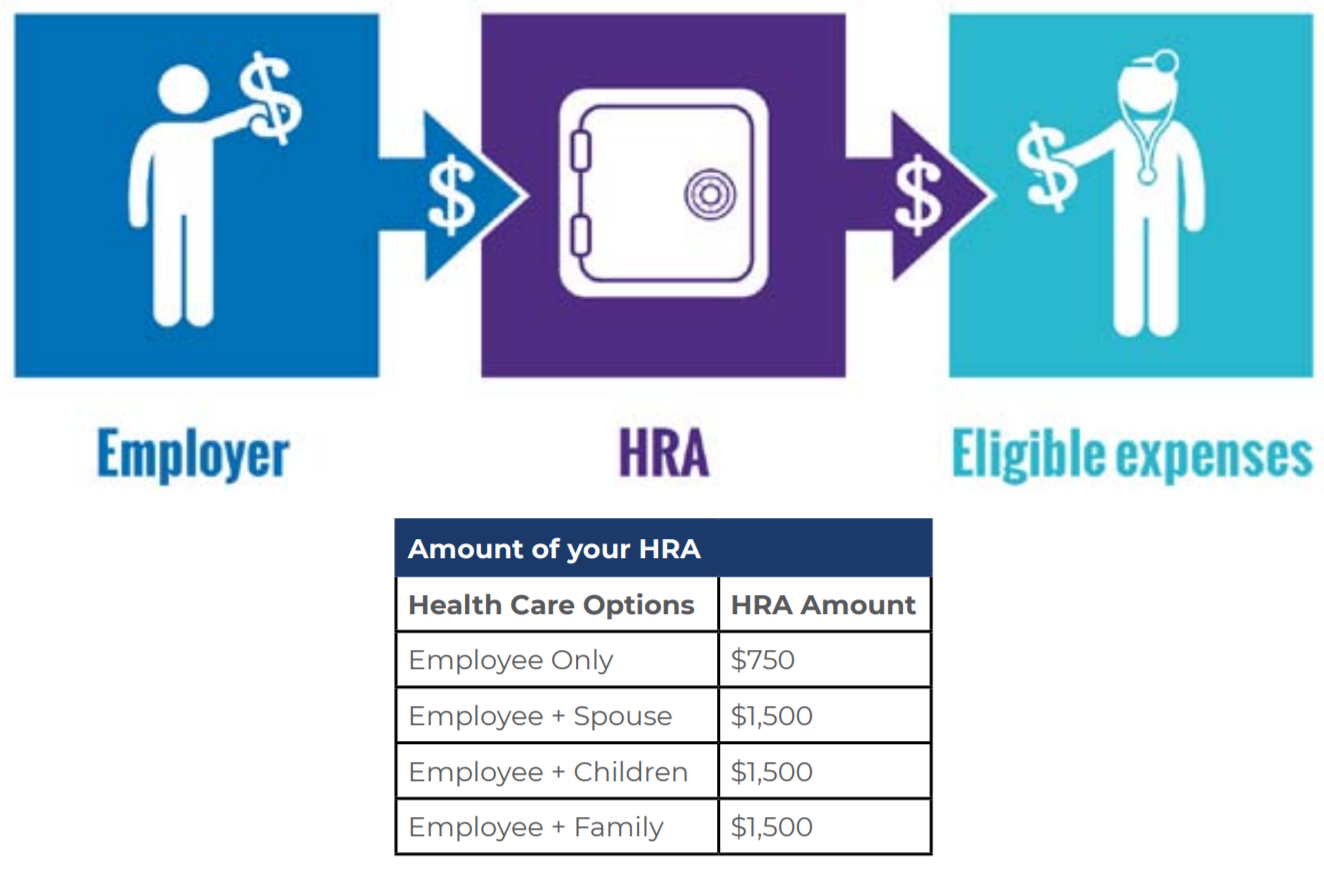

How HRAs Work

Additional information about the HRA is available at: http://learn.healthequity.com/bcbst/hra/#hra_hero or call 1-888-796-0609

Retiree Booklet

Important Contacts

| Benefit/Vendor | Phone | Website |

|---|---|---|

| General Wellness: Employee Healthcare, Retirement & Disability Services | 901-636-6800 Toll Free: 1-866-543-4367 | https://totalrewards.memphistn.gov |

| Retiree Exchange: Via Benefits Medicare | 1-866-201-0367 | https://my.viabenefits.com/memphis |

| Retiree Exchange: Benefits Pre-65 | 1-866-201-0437 | https://marketplace.viabenefits.com/memphis/ |

| Medical: BCBST Medical & Vision Plans | 1-888-796-0609 | https://www.bcbst.com/ |

| Pharmacy: Express Scripts | 1-888-796-0609 | https://www.bcbst.com/ |

| Dental: MetLife | 1-888-796-0609 | https://www.bcbst.com/ |

| Vision: BCBST | 1-877-342-0737 | https://www.bcbst.com/ |

| Deferred Compensation: Empower Retirement Group | 1-800-743-5274 | [email protected] [email protected] |

Frequently Asked Questions

Health Reimbursement Arrangements (HRAs) – Frequently Asked Member Questions (FAQs)

What is a Health Reimbursement Arrangement (HRA)?

The HRA is an employer-sponsored plan that can be used to reimburse a portion of you and your eligible family member’s out-of-pocket medical expenses, such as deductibles, coinsurance and/or copays. It is a financial reimbursement arrangement funded entirely by your employer that is paired with your medical plan.

What are the tax advantages of an HRA?

Reimbursements made from your employer through the HRA are not considered part of your income and are not taxed.

Who can contribute to an HRA?

Only your employer can contribute pre-tax or tax deductible dollars to your HRA.

Who owns the HRA?

Your employer owns the arrangement and determines the scope of how it is set up and used – including the amount you and each employee will receive. The HRA is not portable. If you change jobs, the arrangement and any funds stay with the employer.

How can HRA funds be used?

Your employer may decide what types of medical expenses can be reimbursed through the HRA. Typically, reimbursable expenses can include deductibles, copays, coinsurance costs, prescription drugs, or other types of out-of-pocket costs. Check your Evidence of Coverage or summary plan description materials for details about your specific HRA.

What happens to unused funds in the HRA?

Most HRA funds “reset” at the beginning of the year, though some employers may allow the rollover of unused funds from year to year. Check your Evidence of Coverage or summary plan description materials for details about your specific HRA.

Who Do I Call For Questions About My HRA?

If you have questions about how an HRA from BlueCross BlueShield of Tennessee works, our Consumer Coaches are ready to help. Just call 1-800-527-9206 or e-mail [email protected] for assistance. If you already have a BlueCross BlueShield HRA, you can call customer service at 1-800-565-9140 for assistance.

Can I go online to check my account activity?

Yes, log on to BlueAccess via bcbst.com to view your account balance, claims activity and your Personal Health Statement.

What happens if the HRA amount requested for reimbursement is larger than my available account balance?

Reimbursement requests that exceed your account balance will be reimbursed up to the amount available in the account. Please remember that services must have been rendered before they will be reimbursed.

What if I have HRA dollars left over at the end of the year?

Check your HRA plan design. Your employer may allow your unused HRA funds to rollover into the next year, building up your HRA fund even more.

What if I run out of HRA dollars early in the year?

If you spend all your HRA dollars and still have an amount you need to meet toward your deductible, you will need to bridge that gap with money out of pocket. But once you’ve met the deductible, your health plan begins paying covered benefits with your responsibility limited to any copays or coinsurance that may apply.

What happens if I change jobs from my current employer?

If you leave the company or move to a different employer, your HRA does not travel with you. Since your employer funds the HRA, your employer owns any amount that remains after you leave. An exception may be if you elect COBRA continuation coverage. Check your plan details for more information.

If I have a Health Care Flexible Spending Account (FSA) and a Health Reimbursement Arrangement (HRA) through BlueCross BlueShield of Tennessee, which account will be used first?

The Health Care FSA and HRA, while separate accounts, provide reimbursement of qualified medical expenses as defined by your employer and the IRS (i.e., deductibles, coinsurance, prescription expenses). Should you have both accounts, expenses eligible under both plans will be reimbursed through the HRA first, then default to the FSA, The HRA will pay first, unless your employer specifies that the FSA will pay prior to the HRA. One reason to have the FSA pay first is because unused FSA money does not carry over.

How soon after enrollment does my HRA start to pay?

Your employer has the choice of allowing the HRA to pay before you meet any deductible, or it can be set up so that you have to meet a certain amount of out-of-pocket expense before the HRA begins to pay. Check your plan details for more information.

What happens to my account(s) if I terminate employment?

You will have a limited period of time to submit additional requests for reimbursement of qualified medical expenses incurred while you were employed, and, at the end of that period, the account balance will be forfeited.

What is Automatic Reimbursement?

Automatic reimbursement is an optional feature from your employer that submits the liability portion of your health care claim and automatically processes it against available HRA funds. If funds are available, a reimbursement is then sent to the health care provider along with any applicable medical coverage payment. Automatic reimbursement is one of the most important and desired features of our HRAs as it eliminates paper work for you.

If you have automatic reimbursement and use a network provider, your provider will submit a claim to BlueCross BlueShield of Tennessee. We will process the claim in accordance with your health plan design and pay the provider (on your behalf) any HRA amount that applies. You will receive an Explanation of Benefits form showing how payment was applied. If your HRA applies to prescriptions, you will be required to pay up front at the pharmacy and if there is HRA money available, the reimbursement will be sent directly to you.

How do I submit a paper (manual) request for reimbursement?

In most circumstances, you will not need to submit a manual request for reimbursement. If the situation arises, requests can be made using an HRA Reimbursement Claim Form. Claim forms are available online at bcbst.com

Simply complete and sign the claim form and attach one of the following:

- Your Explanation of Benefits from BlueCross BlueShield of Tennessee, or

- Receipts for prescriptions or qualified health-related

1 Cameron Hill Circle 0022

Chattanooga, TN 37402-0022

Fax: 1-888-666-1221